This year Facebook is 15 and Google is 21, but as advertising channels for big brands, neither has emerged from the troublesome teenage phase into a fully effective adulthood.

It’s because marketers are often not using these and other online channels appropriately: Online ads perform two distinct tasks that need two different decision-making processes, but many marketing departments only use one.

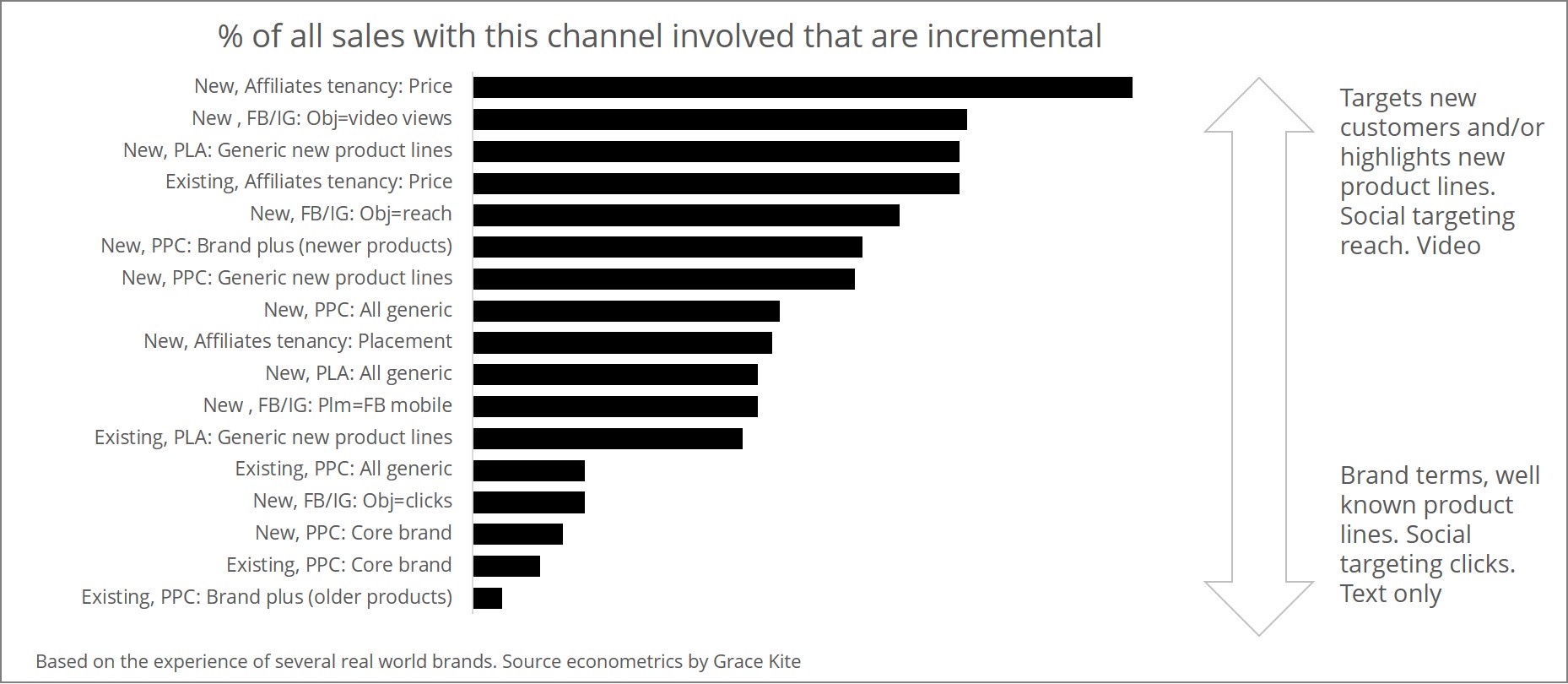

The first task is the one that marketers are most comfortable with because it is the same task that’s done by offline ads. If seeing a compelling picture on Facebook is similar to seeing a poster on the street, and watching a video on YouTube is similar to watching one on TV, then it’s clear, an online ad is just like an offline one. It’s an investment into generating demand and producing future sales.

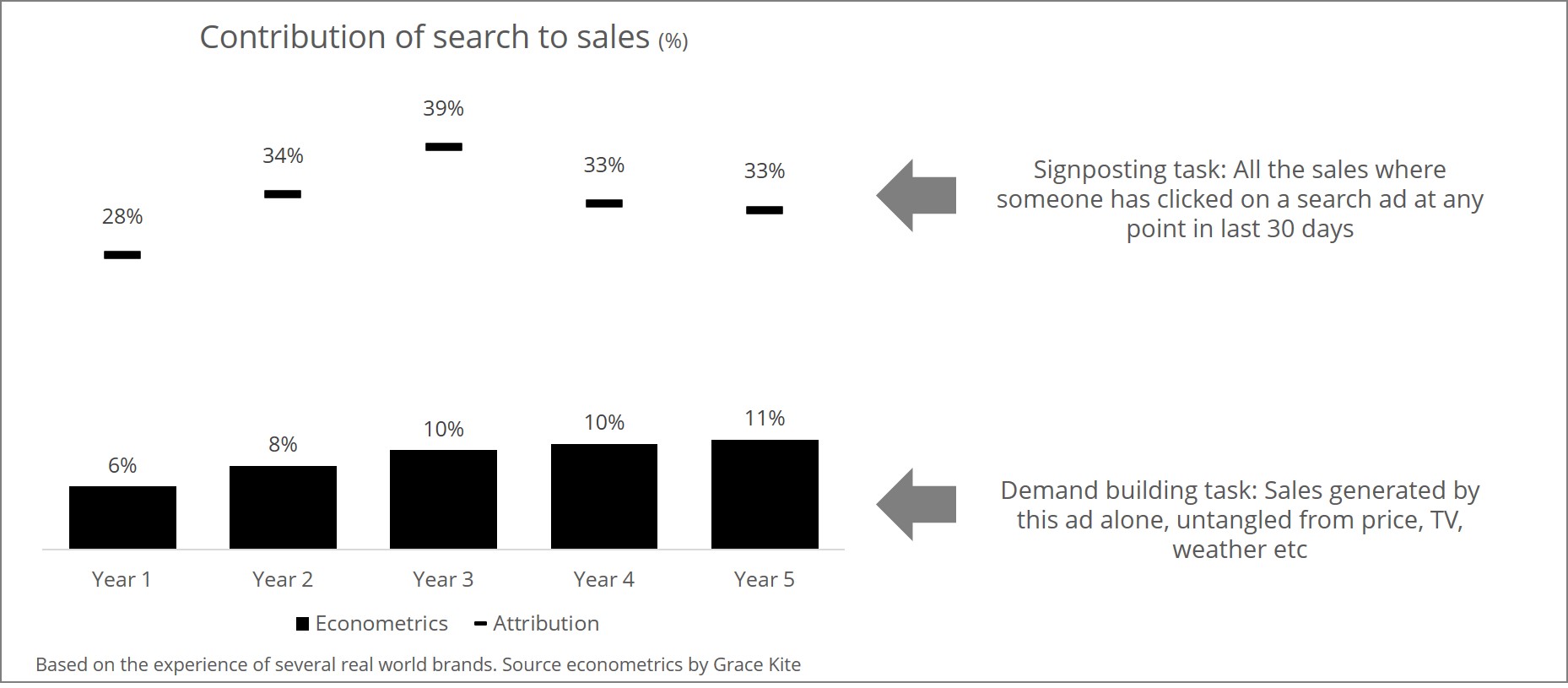

The second task is less familiar to marketers, albeit equally important for sales, it’s the role of online ads as signposts for e-commerce businesses. This task is the online equivalent of the name above the high street front door, the lights that stay on inside, the shelf-space, and even the entry in the yellow pages. The task is to help people who are already on their way to a business website to arrive safely, it isn’t an investment into future sales, but a cost of current transactions.

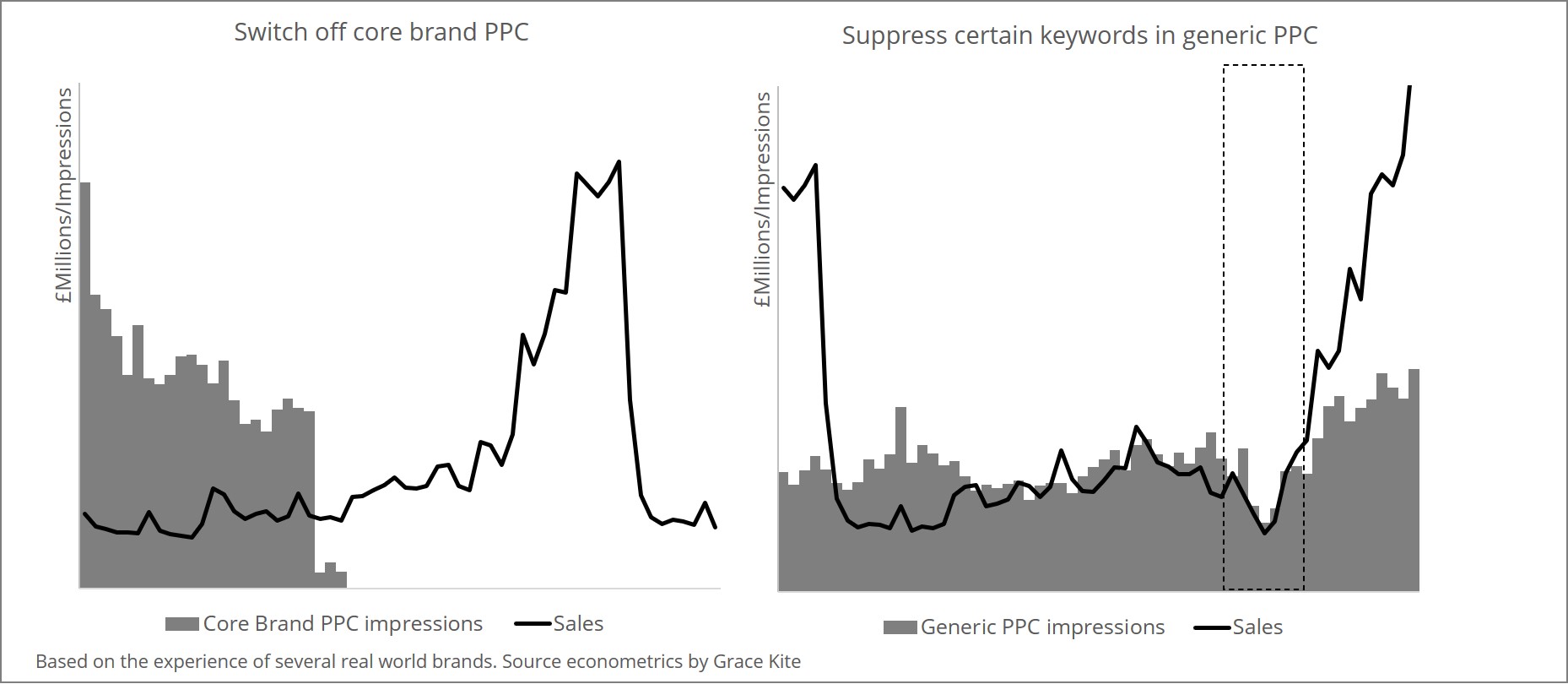

The two tasks can lead to flawed decision-making when ads that mainly perform the second task are treated as if they perform the first. It can lead businesses treat signposts as if they were substitutes for true investments into future sales and, in some cases, waste money shepherding sales that were going to arrive anyway.

Making sense of the macro data

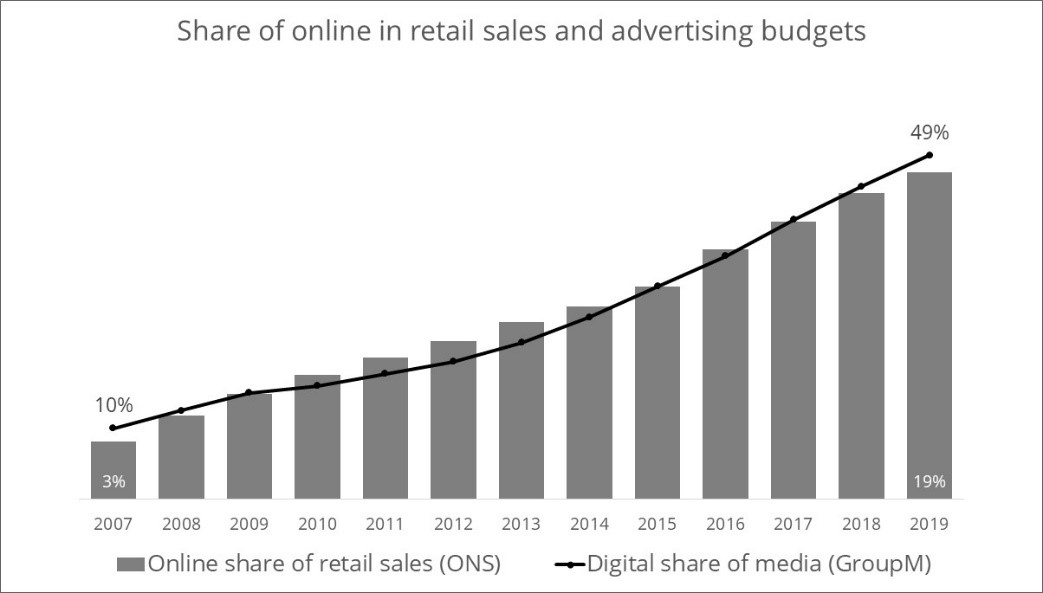

The existence of the second task explains the matching trajectories in the chart below. In it, online advertising’s share of budgets (black line) and the e-commerce share of retail (grey bars) have been growing in parallel for as far back as the data is available. At least part of the explanation is that some online advertising is a cost of carrying out e-commerce. Businesses that want to sell on the internet need to be visible there.