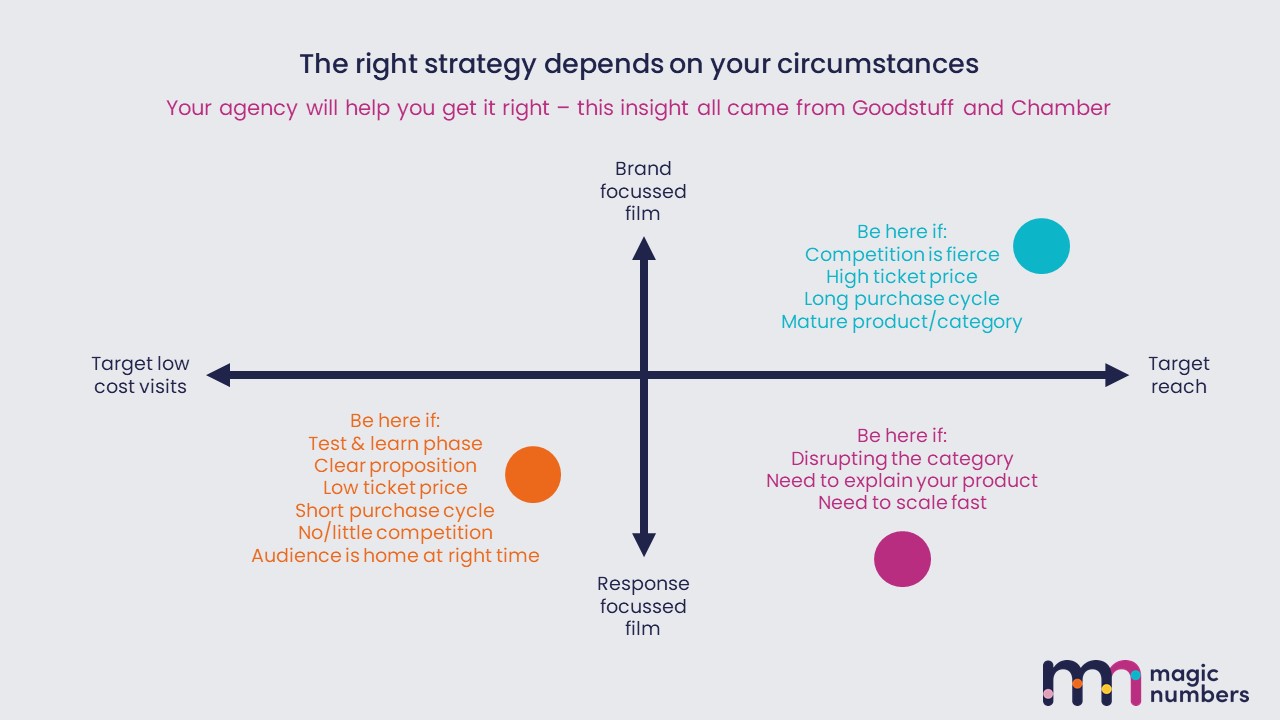

Agencies are also really good at knowing what the right thing to do is for your specific circumstances

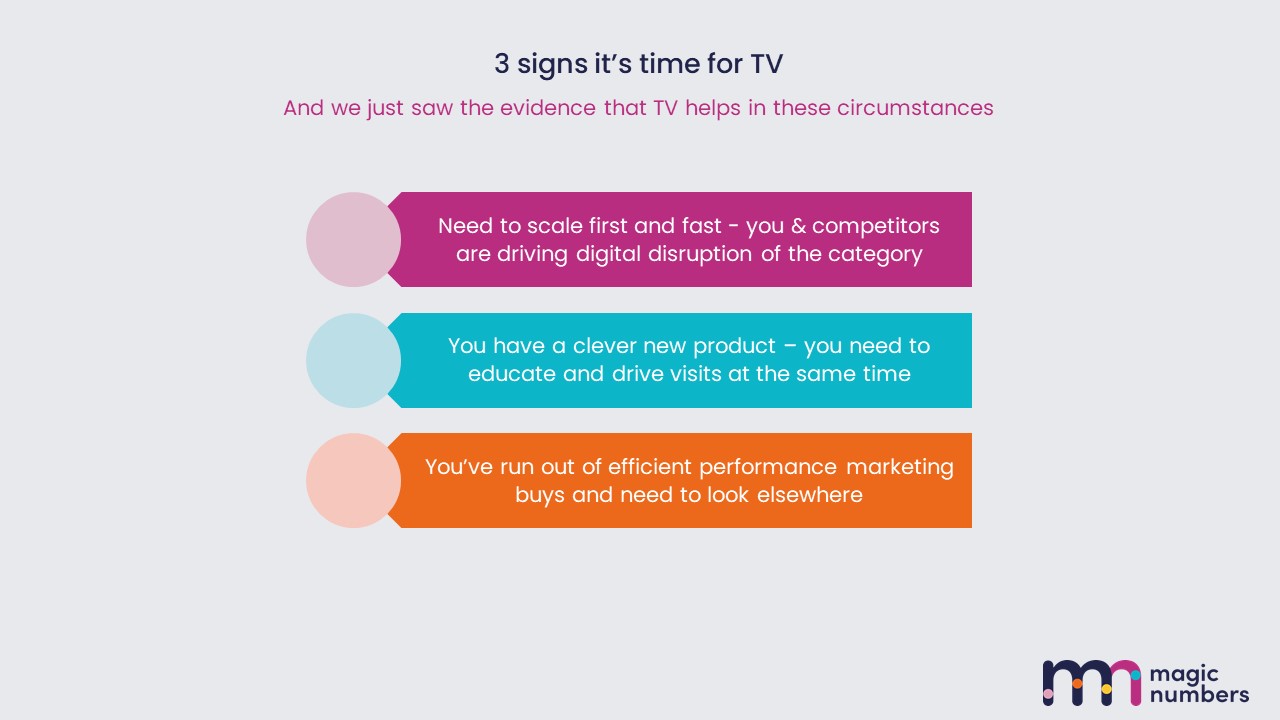

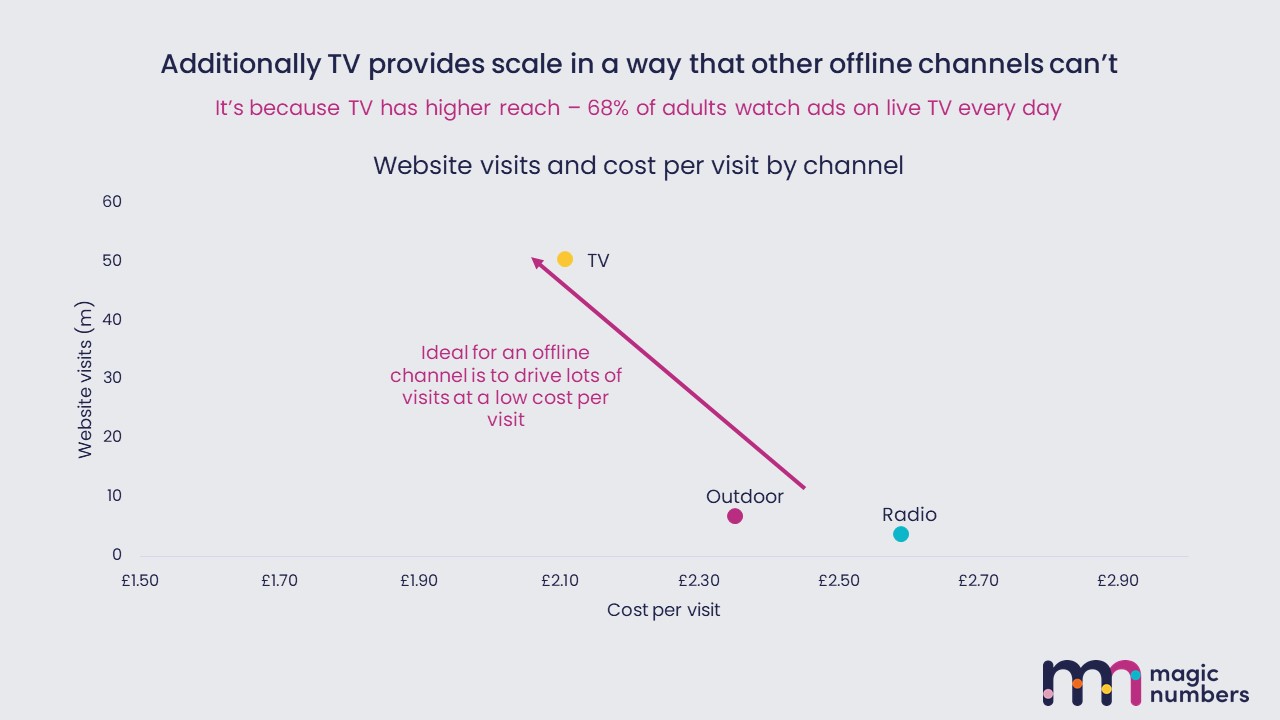

So, you may start in the bottom left on this chart, targeting low-cost visits with a response focussed film. And actually, you may well never need to move from that quadrant if your circumstances are right for DRTV. That is when the sell is not particularly hard…. you’ve got a product that’s easy to understand and not too expensive, the competition isn’t too fierce, and the target audience is watching telly when cheap slots are available.

But in some circumstances, where the sell is a bit harder, you may need to move out of that quadrant. If so, you’ll pay a bit more per visit, but reach more people and get a larger scale response, and you may invest in a richer creative that is capable of much more persuasion too.

If you go for both, you’re going to be moving towards the blue corner on this chart – this is where a lot of the Christmas ads that are starting to come out at the moment are. They know that competition is fierce, they know shoppers’ Christmas gift shop is a big outlay, and something that really matters to them. Reaching as many people as possible and bringing out the big guns to persuade them to your brand is critical.

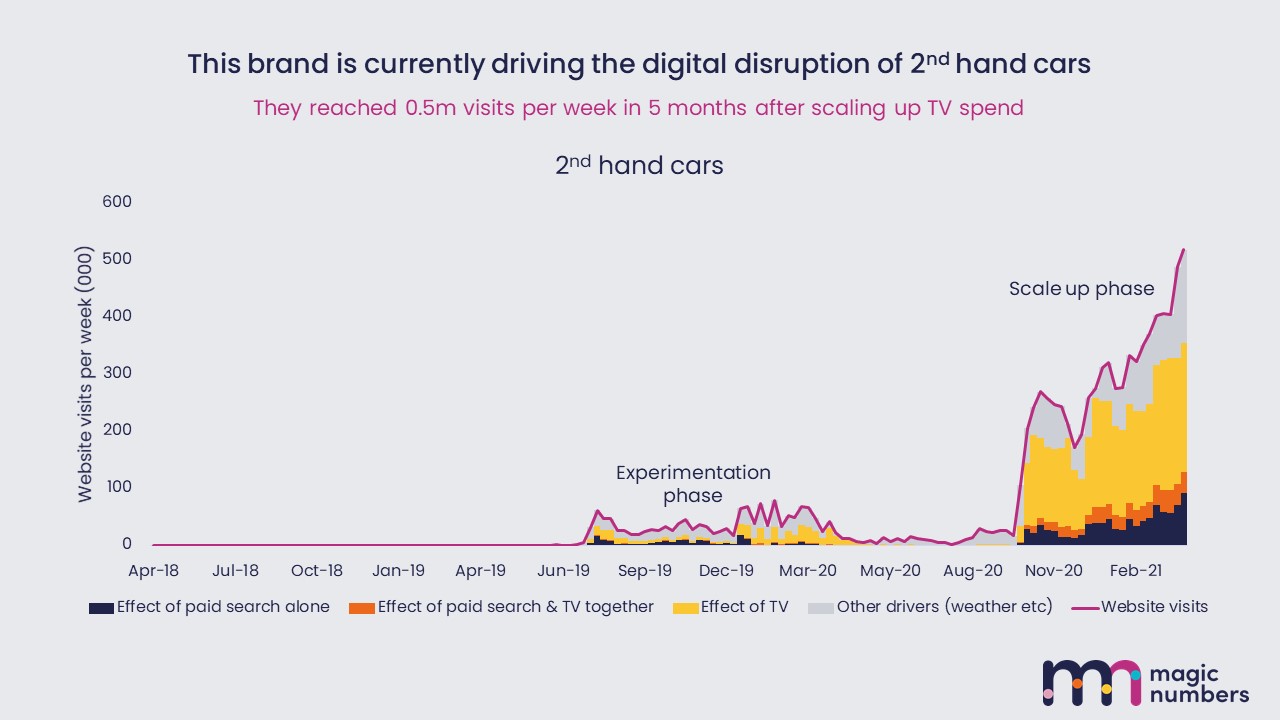

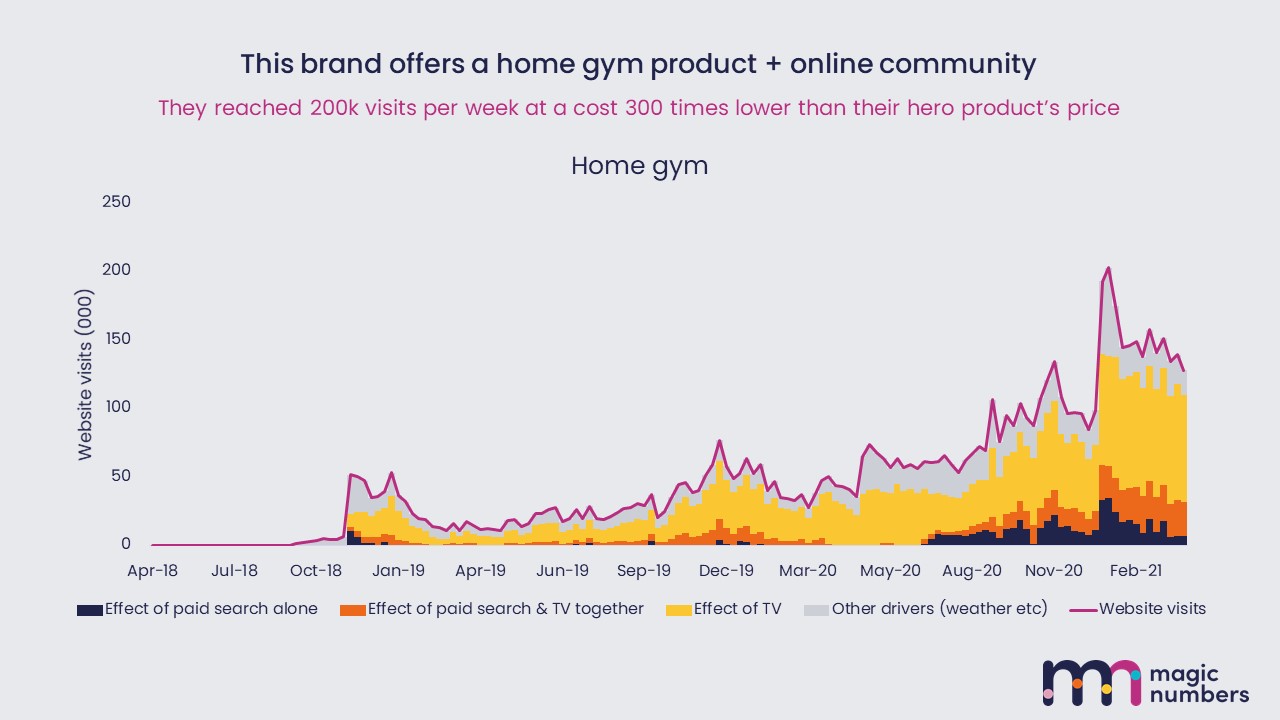

The pink corner is one that’s not typically talked about so much. But this is an important option for many online brands and particularly those that are disrupting their category, doing something very different, or need to scale fast.

This is where you try to reach as many people as possible, but the ad itself doesn’t have to be that persuasive – the new way of doing things is better, right? The job for the ad is to introduce that new way and explain it.