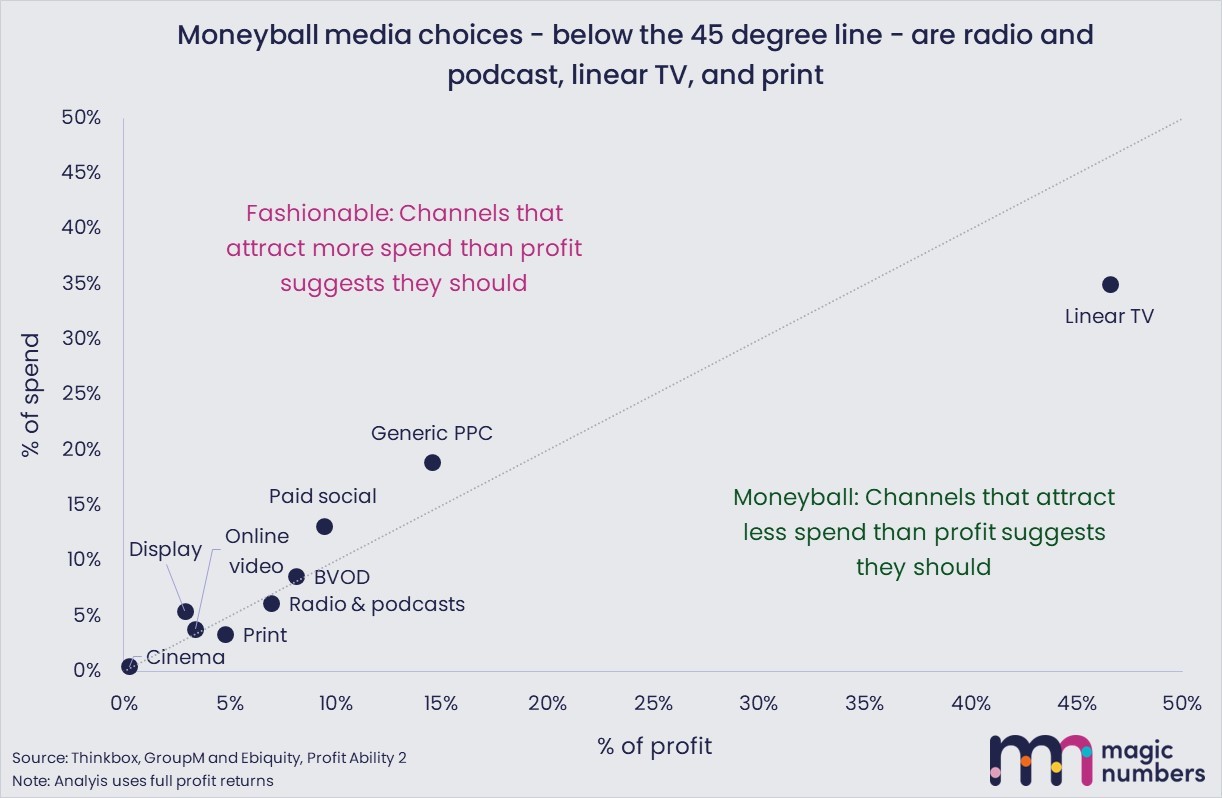

It reveals a bias in favour of newer, sexier, and typically online media channels. The “fashionable” group – where people are spending more than they should – includes generic PPC, paid social, and display.

Cinema, online video and broadcaster video on demand are on the 45 degree line. Neither fashionable, nor unfashionable, these are broadly being bought in line with what they can deliver.

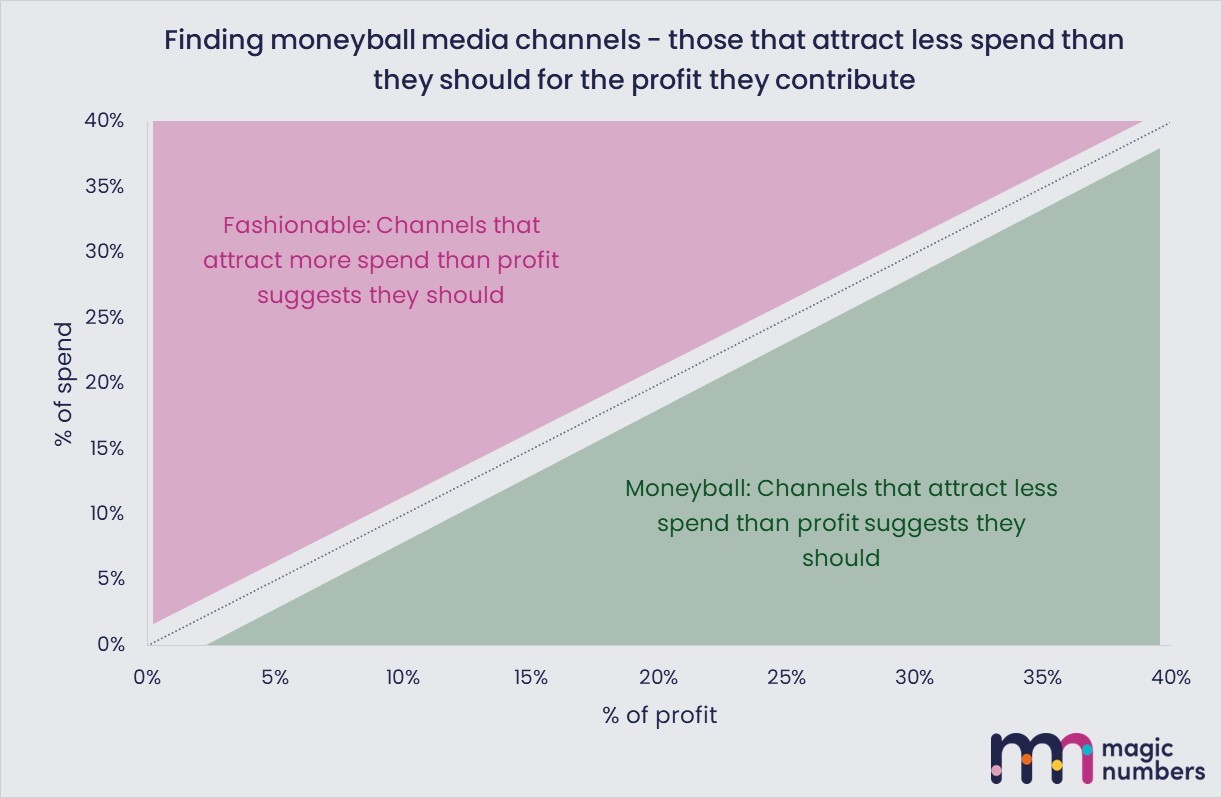

South of the line is where the opportunities lie. Because here is where there’s a bias in media buying against a channel, less demand than there should be, and so, the possibility of bagging a bargain.

It is the traditional, and typically offline channels – radio & podcasts, print, and linear TV – that appear here. And it is these are the channels that return the highest total profit per £1 spent of all channels in the study.

A pendulum that’s swung too far

It’s a finding that will feel weird to many marketers. It seems wrong to do more linear TV ads, when fewer people watch live telly than ever before. Wronger still to do print, when you can hardly even buy a real life newspaper.

But it does make sense, because shifts in how people consume content happen slowly, bit by bit, over time. On the other hand, we who decide on media are “on it” professionals, who react to signals as fast as we can.

This evidence suggests that we’ve moved too far too fast.

Take print as an extreme example: 63% of businesses in the study that could be tracked over time stopped using print altogether in the last 5 years. Only those who measured a really very high ROI continued to buy it, and many who got middle-high ROIs, nevertheless dropped print from their plans.

Something similar but less extreme happened with radio & podcasts, and linear TV. So that now, post-covid, marketers that continue to buy these three channels are shopping in a market with low demand, and so getting good value for money.

Over-investment in online channels

At the fashionable end of the chart, the story is of over-investment in online channels.

These channels absolutely deserve their place on the plan. Paid search, paid social, and display are often cheaper for a direct response than what came before them, and in some places they’re doing a brand job too.

But we spend too much.

Perhaps it’s because – as the research demonstrated for paid search – these channels pay back quicker and we’re impatient for our ROI.

But perhaps the reason isn’t as rational as that.

What if it’s because online channels come with measurement platforms that’ve become part of everyday life and steer us in a positive direction? Or if it’s because they come with a rep that’s always in touch?

What if it’s because they’re just cooler?

As brave as Billy Beane, as smart as Pete Palmer

Pete Palmer isn’t as famous as Billy Beane, but he played an important role in the moneyball story. A sports statistician and encyclopeadia editor, he helped design the model that helped Billy find undervalued players.

What he saw was that, in choosing with the pack, baseball managers picked the strategy they believed was least likely to fail, or that wouldn’t attract criticism. That led them to ignore players that would otherwise have helped them win and in turn opened up the opportunity that the Oakland A’s exploited.

Coming back to marketing, and a similar set of lessons apply. Research like Profit Ability 2, or better still, MMM/econometrics focussed on your own business, can deliver the numbers and find you the moneyball media channels.

But you also have to have a Billy Beane.

Someone in your team who’s brave enough to go against the grain when that’s where the wins are. Who’s enough of a hero to take one on the chin for the business. And, who’d maybe even be played by Brad Pitt in the story of your success.