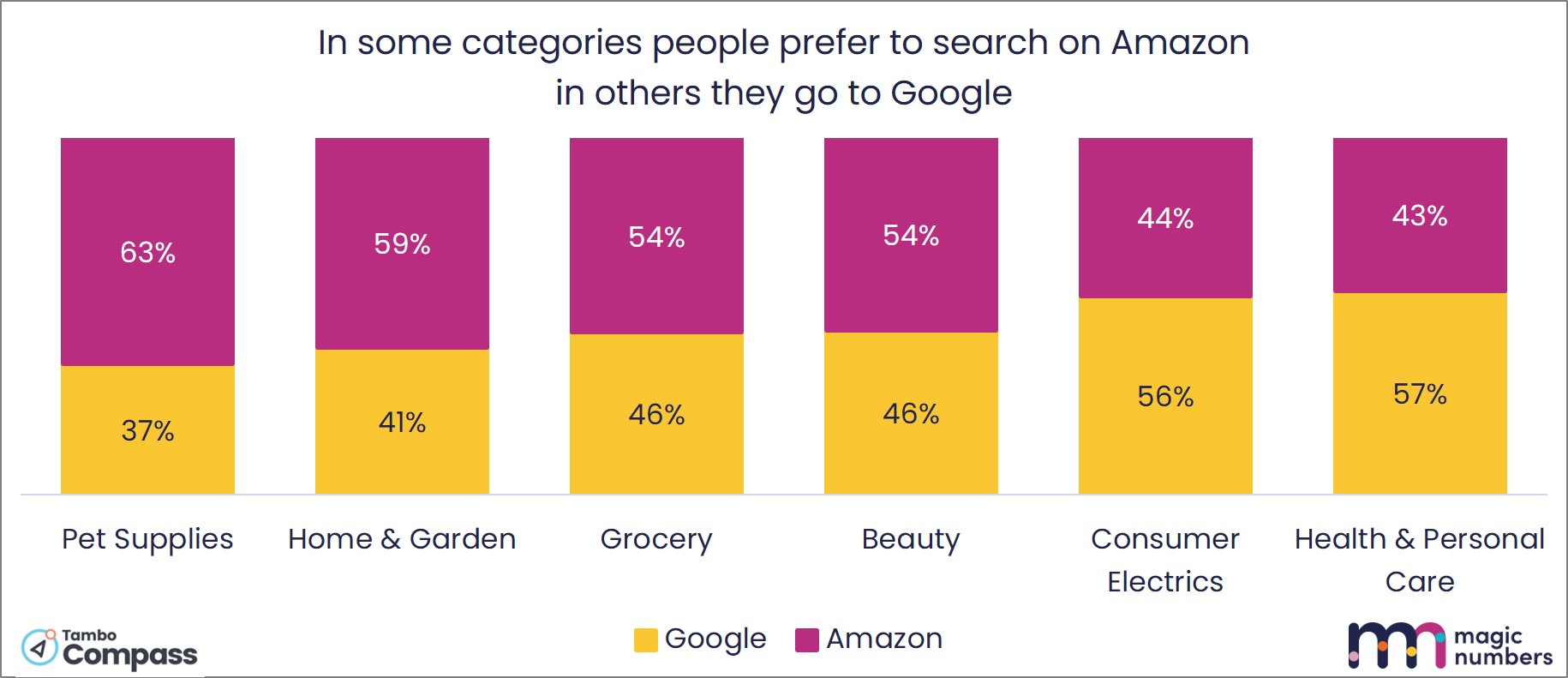

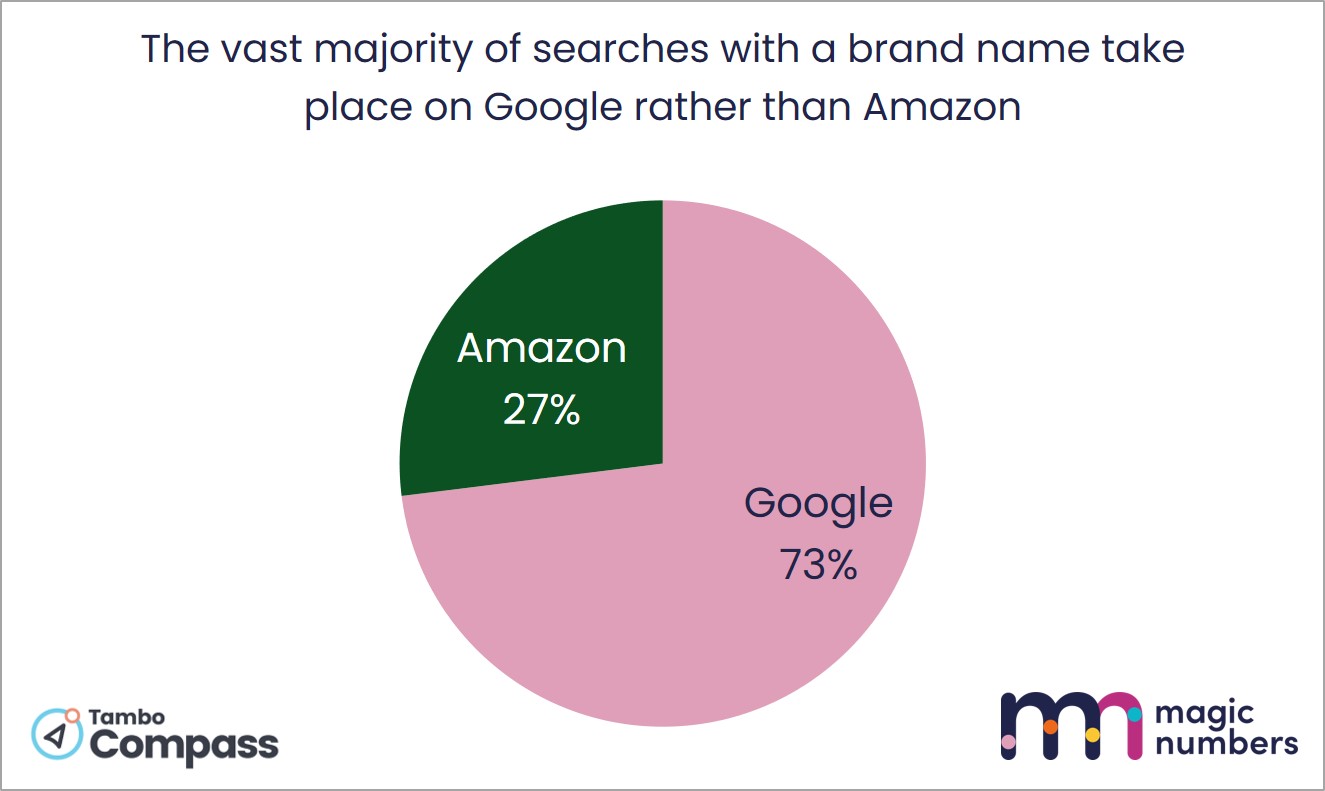

This suggests that if you’re small and unknown, starting out on Amazon is one route to gaining enough brand awareness to later win on Google. But, on the other hand, if you’re already big, and people already search directly for you, there may be less to gain from paying to appear amongst the jostle of suppliers that Amazon’s algorithm serves up.

Good measurement matters

You’ll never get these kinds of insights using the last-click attribution that comes packaged with Amazon ads. As Amazon themselves would admit, it’s important to instead use measurement that can properly identify whether a sale was caused by the Amazon ad or something else earlier in the purchase journey.

The issue is that last-click wrongly attributes credit for everything that’s happened in the journey to purchase to the event that happened last, just before a customer presses “buy”.

Because Amazon very often appears at this last moment, at the end of people’s purchase journey, when they’re already intending to buy something, last-click hugely over-allocates credit to Amazon. In our cases, the overclaim for ROAS is in Amazon’s last-click is dramatic and very misleading – estimates are 300-400% out.

So, it’s dangerous to test, learn, and invest into Amazon ads without independent econometrics, switch off tests, or regional hold outs.

Saving Amazon?

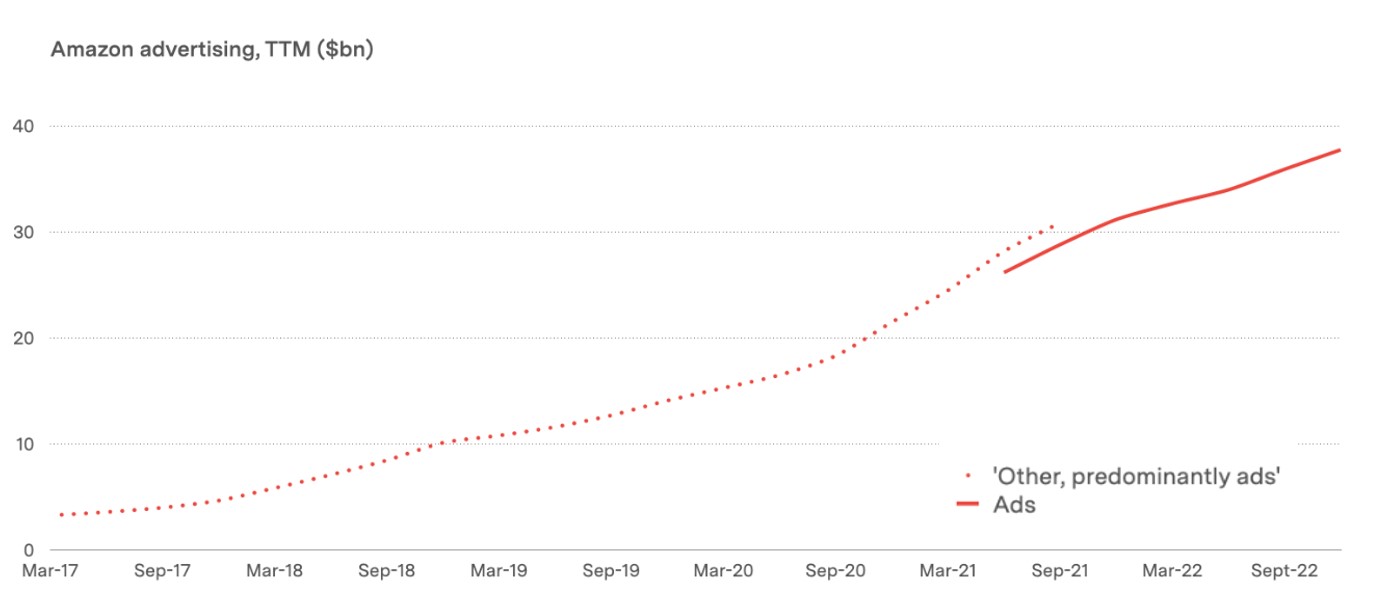

To emerge from their current vulnerable moment, Amazon’s senior management, along with financial analysts, are pinning part of their hopes on the advertising business.

And the advertising sales teams are certainly doing their bit. They were everywhere at Cannes in 2022, a main sponsor of Ad Week in 2023, and they’re directly contacting marketing budget-holders everywhere.

But it is marketers who will decide whether the strategy ends up working. Through experimentation and evaluation, we’ll find the right place for Amazon ads in our media budgets. And maybe, if we’ve collectively learnt enough about the dangers of last-click, we’ll get to maturity quicker than we did with Google and Facebook.

In the meantime, Amazon would be wise to keep an eye on the core business. Google’s genius has always been in selling ads while never undermining their value to users. For Amazon, that’ll be much harder to pull off.

Amazon’s core proposition is pointing shoppers to the best value item amongst all the options, something that is at odds with an additional proposition to point shoppers at whatever advertisers pay to support.

Just like their rainforest namesake, Amazon currently needs saving. It remains to be seen if advertising really can come to the rescue.