In 2020 online advertising is neither new nor under-analysed, and yet – according to a recent article in the Economist – there remains a fundamental misunderstanding about the role it plays.

Businesses think that all digital advertising belongs in the same bucket as TV or posters, so they pay for it out of their marketing budget, monitor its return on investment and increase it at the expense of other channels.

This makes sense for some types of online ads, but others aren’t like traditional advertising. Their job is not to drum up demand. Instead, as a recent article in The Economist pointed out, they are “the new rent” . Now that e-commerce is so prevalent, fewer businesses need to maintain a physical presence with a high street shop, but they do need to maintain a virtual presence and that’s why they purchase these ads.

Their purpose is to help people who are already on their way to a business to arrive safely. They replace the sign above the shop front, the lights that stay on inside, the shelf-space, and even the entry in the yellow pages.

It shows in the data

My job is to estimate econometric models of individual firms’ sales, and these models often show that some types of digital marketing don’t drive incremental sales.

Econometrics is not a perfect analytical technique, but ours are done to IPA awards standards every time, and we believe the conclusion: These ads aren’t driving new sales, rather they are easing or defending sales driven by other things – price, the economy, and advertising on traditional channels.

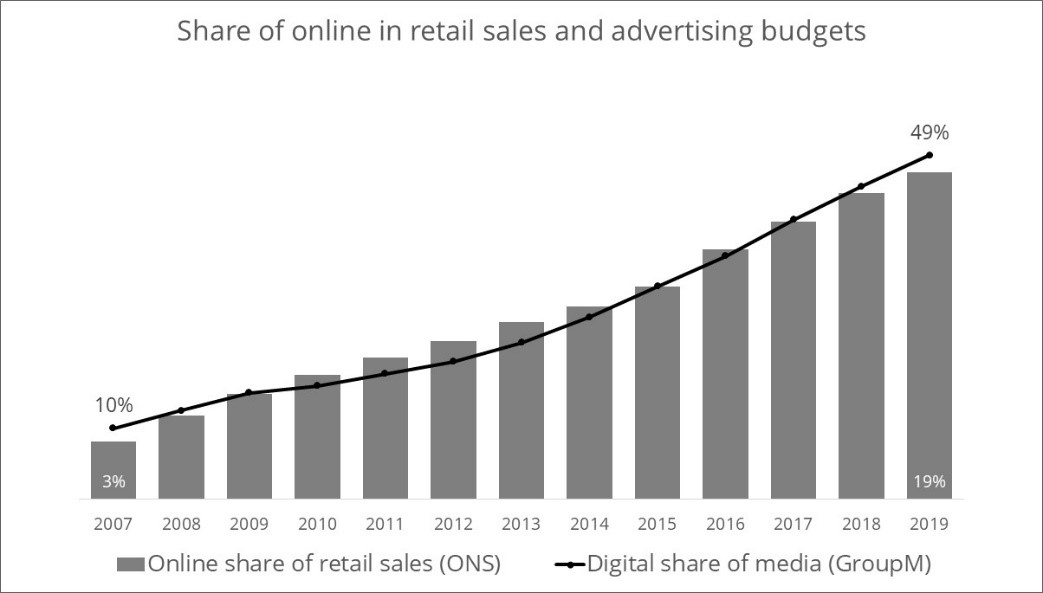

The macro data points to digital ads being rent-like too. It shows that the rise and rise of digital advertising matches the rise and rise of e-commerce. Correlation isn’t causation, but its surely not a coincidence that the line in the chart below, digital share of spend, is heading north-east in parallel with the bars, % of retail that’s online.