It’s that time of year again. The kids are sporting brand new, slightly too big school uniforms, we’re tightening our belts and the purse strings after a jolly summer, and, at work, the questions are all about next year’s budget.

This time last year, Mark Ritson said the answer to these questions is “chips”.

To make chips posh, he said, Heston Blumenthal fries them three times. And to land on a decent budget, you should take three steps too: Spend 10% of turnover on ads, split it between long and short using Binet & Field’s guidelines. Air it, then evaluate vs. the objective you set at the beginning.

And he’s right of course. On the most important steps that every marketer should take, he always is.

But for an approach that’s a bit more context-specific, a bit less one-size-fits-all, you need to dunk your chips in the fryer one more time.

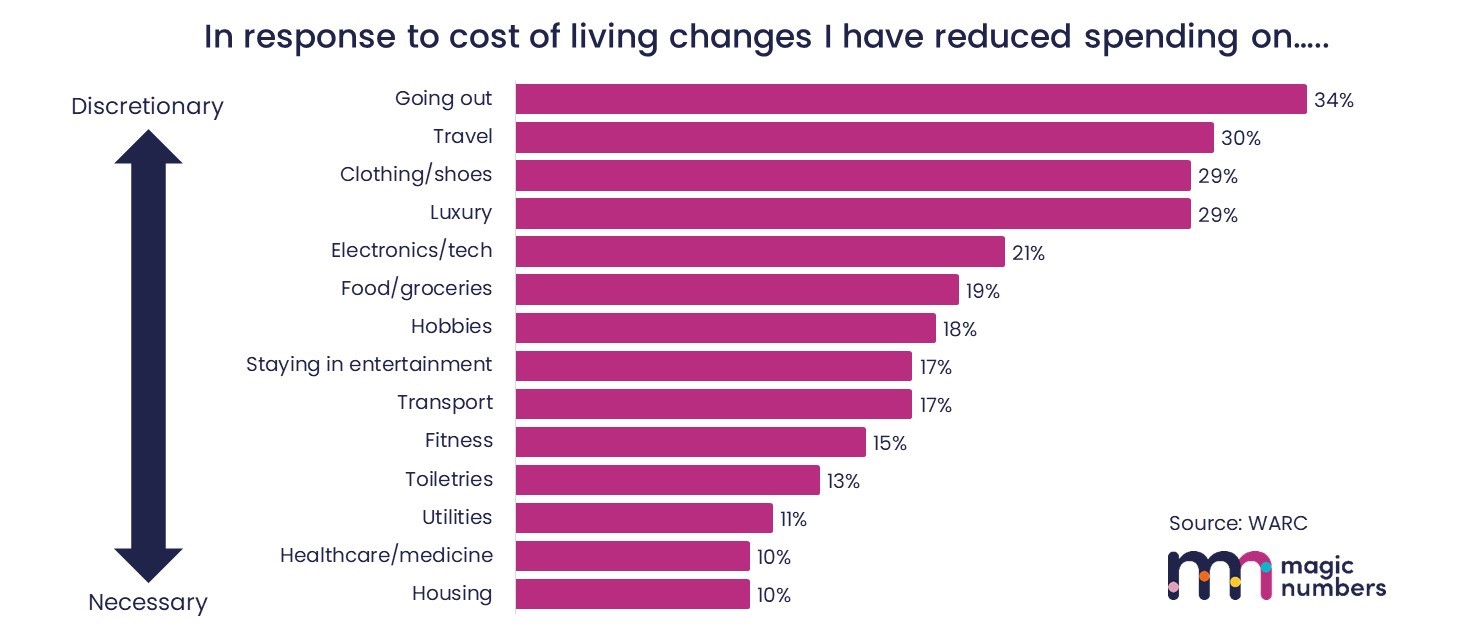

Because it’s worth adjusting your budget in line with the extent of the opportunity ahead of you. That means the strength of demand in the economy, your target market, and your category.

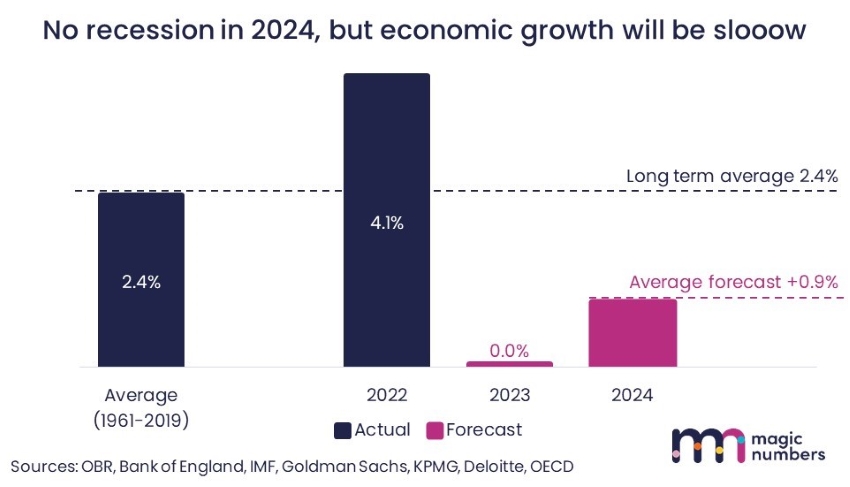

No recession, but growth will be slow

The good news is that in all the recently published forecasts, economists are much more optimistic than they were. Inflation is slowing, coming under control. And although higher interest rates will damage people’s finances, economists agree this won’t be enough to cause a recession.