It’s not surprising that marketing people think finance are the bad guys.

Afterall, if you don’t understand them, it looks like they go around doing exactly what movie villains do: randomly killing just to prove how big, bad and evil they are.

Then, when they explain why they’ve killed your idea, they sound like a baddie all over again: ‘I’m bringing order to this chaotic land (ahem, company)’, they say. Or, ‘even though it’s nasty, I have to do this, there’s a bigger scheme that justifies it, one that only I can see.’

It feels like the movie’s going to end badly, but there’s a plot twist. Because the way to win support and money for your best marketing ideas isn’t to defeat the villains, it’s to recognise that they aren’t villains after all.

To learn how they think and bring them what they need.

You’re going to have to change your great concept into numbers

It’s sort of obvious to say it, but finance people do like a few numbers.

In interviews my team at magic numbers did with seven CFOs and Finance Directors, this was the minimum viable thing to bring to a budget discussion. Table stakes.

Finance needs something concrete that shows this marketing is going to put more back in the company’s bank account than it takes out.

Solid evaluations of what happened in the past matter a lot, because they inform what will happen next. Everything from graphs and charts that illustrate past stories, through to analytics and especially econometrics done by an unbiased third party.

Whatever you present, your CFO or FD will doubt your numbers. Even though you’ll probably find that terrifying, they’re not doing it to be evil. It’s just part of their job description to question plans.

“It’s our role to question the business case. We may have a scenario based on the past, but last year was different, because there was a heat wave. So, is the expectation going forward based on wonky foundations?” Rupert Morton, Finance Director, ex-Secret Escapes

The trick that stops the conversation being a confrontation is having more than one version of how it’s likely to go: A best case, worst case, and a middle one.

And the move that brings both sides into the same team is knowing what causes each of these futures to happen and having an agreed plan to cut losses in the worst-case.

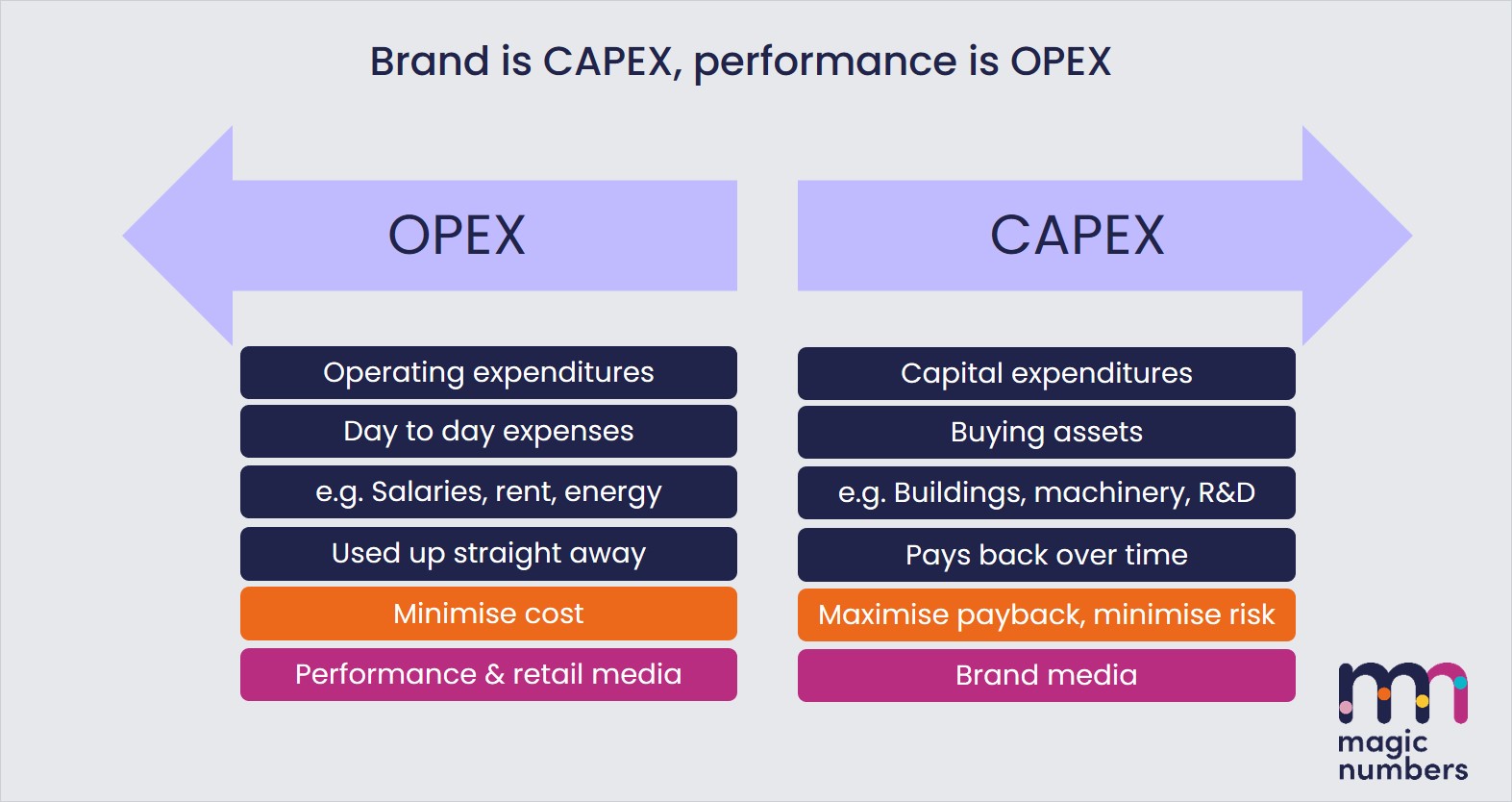

Present brand as CAPEX, performance and retail as OPEX

For finance, every expenditure has to be either a capital expenditure – where you buy something that pays back later – or an operating expenditure where you pay for something that’s used up straight away.