Three case studies

The first example is an FMCG marketing director who, despite having a quality product to sell and an established, well-loved brand, was presiding over slowly declining sales and share.

With the cost-of-living crisis biting and pressing initiatives elsewhere in the business, discussions were about whether it was even possible to maintain last year’s budget. She believed significant increases were needed but had no way to prove it.

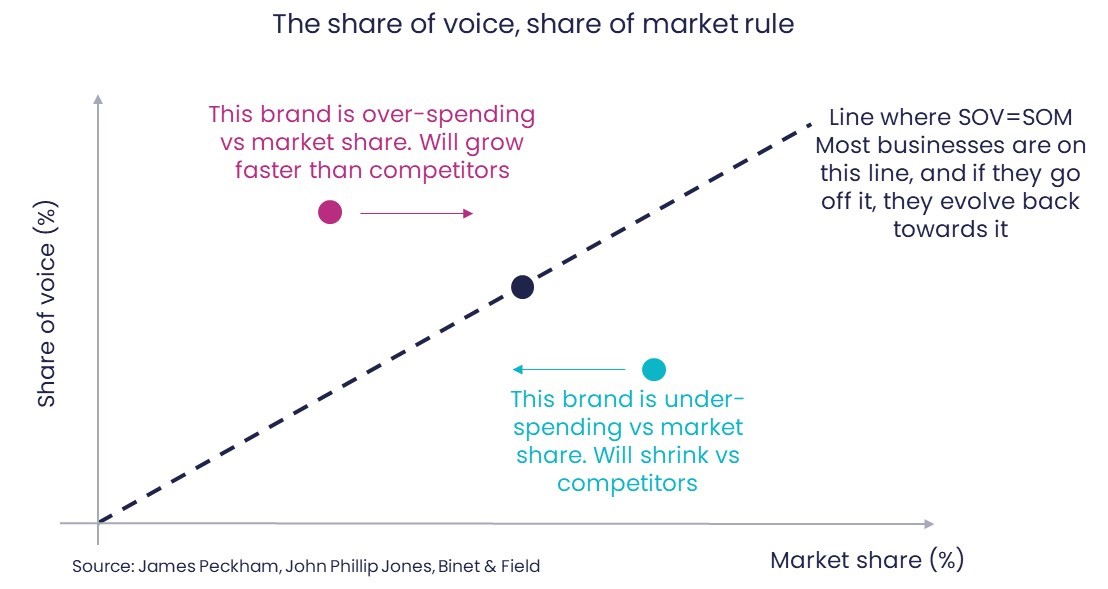

With help from her insight team, she used the tool to carry out share of market, share of voice analysis. It demonstrated that the reason for slow decline was that year after year, this brand was being outspent by a competitor with deep pockets.

She showed her CFO that the budget needed just to maintain market share at its current level was quite a bit higher than last year’s spend and so secured a bigger pot to play with.

But the outcome from this kind of wargaming isn’t always “spend more”.

In the second example, a manufacturer of a fun but expensive gadget, the right decision was to delay their planned campaign.

Even though the budget levels they were suggesting would bring market share gain, economists’ forecasts of demand in their category were low. Because of the cost-of-living crisis, people were delaying purchases like theirs.

The media planner ran scenarios that showed the same spend would bring better returns in 2025, when demand was back to normal. So, they shelved their plans in the short term.

The outcome was different again in the third example, because the ask from finance was not to justify a budget request, but to understand the risks of continuing to outspend competitors.

It was a particularly uncertain time because their category had seen huge sales figures during the pandemic. The product has a long purchase cycle, and the worry was that demand would be lower going forward.

They worked through a wide range of feasible futures, iterating through possible things competitors might do, possible trajectories for media costs, and both optimistic and pessimistic economic scenarios.

Taken together, these showed that, actually, the range of possible financial outcomes was narrower than the CFO feared.

The budget didn’t change much from what they originally planned, but they were able to move ahead feeling confident with their plans and alert to changes in the outside world that would mean it was time to change tack.

Get a planner in your life onto it

This kind of wargaming isn’t everyone’s cup of tea, and you do need to collect a bit of data about what’s happened so far.

So, find a planner in your team or media agency, or, failing that, someone you know who’s usually good with spreadsheets.

They’ll get stuck in, and before you know it, you’ll be marching into budgeting conversations with the CFO, board, or investors fully kitted out with the business case you need for an stonking 2024.