In Doctor Who, or House MD, or 24, each episode is a story, but the characters are also part of a bigger plot. Things that happen each week play into overarching ups and downs. Questions, conclusions and journeys.

And marketing effectiveness is like that too. Each marketing team, each creative vehicle, each media plan has a story, but there is also a larger tale. It’s about whether we are generally making better choices than we used to. And about whether new things we’ve collectively tried helped or not.

The big story that our industry has been telling itself in recent years is that there’s a crisis in effectiveness, that our ability to sell stuff using ads is in decline.

It really isn’t a great message PR-wise. It’s useful if there’s a problem and we need to course-correct. But if not, it’s a message that undermines marketers’ ability to do their jobs. It’s already easy for CFOs to question whether marketing is worth it, and divert budget to other things. The simple message that marketing works bears repeating. We complicate the take-out at our peril.

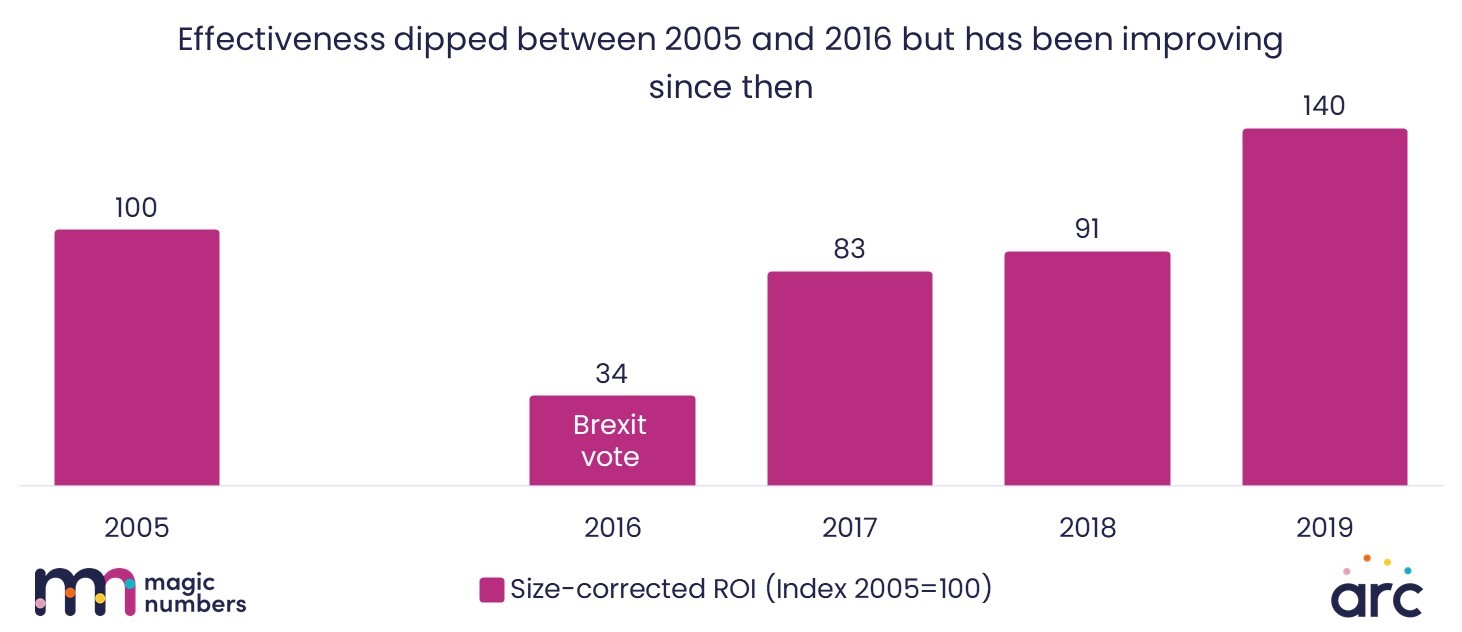

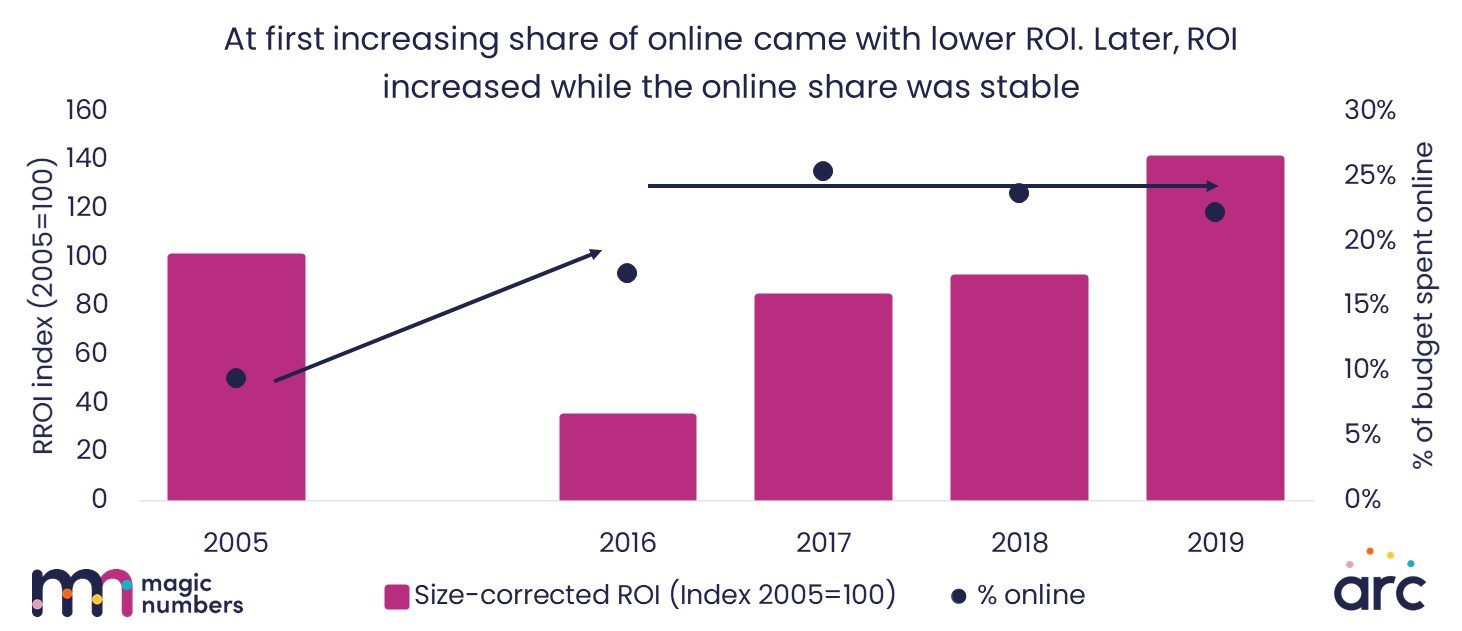

And there’s now new data that adds a chapter to what we know. It suggests that any general crisis of effectiveness is over now. Return on investment has been increasing in the last 5 years, and it’s now at comparable levels to 2005.

The big ups and downs

Evidence on these issues is never going to be perfect, but in 2021 there was a big step forward. A group of analytics companies – D2D, IRI, OMG, VCCP media, and magic numbers – agreed to share anonymised data on UK advertising they’ve evaluated using econometrics.

This built into a database that was quite a lot bigger than others like it that had come before. And for once, it didn’t just have award winners in it. It was named ARC for the advertising research community that came together to build it.

The data suggests that currently there is no crisis. The average return on investment in recent years – amongst ordinary, unawarded campaigns – is £3.80 in revenue per £1 spent on advertising. And effectiveness is not in decline.